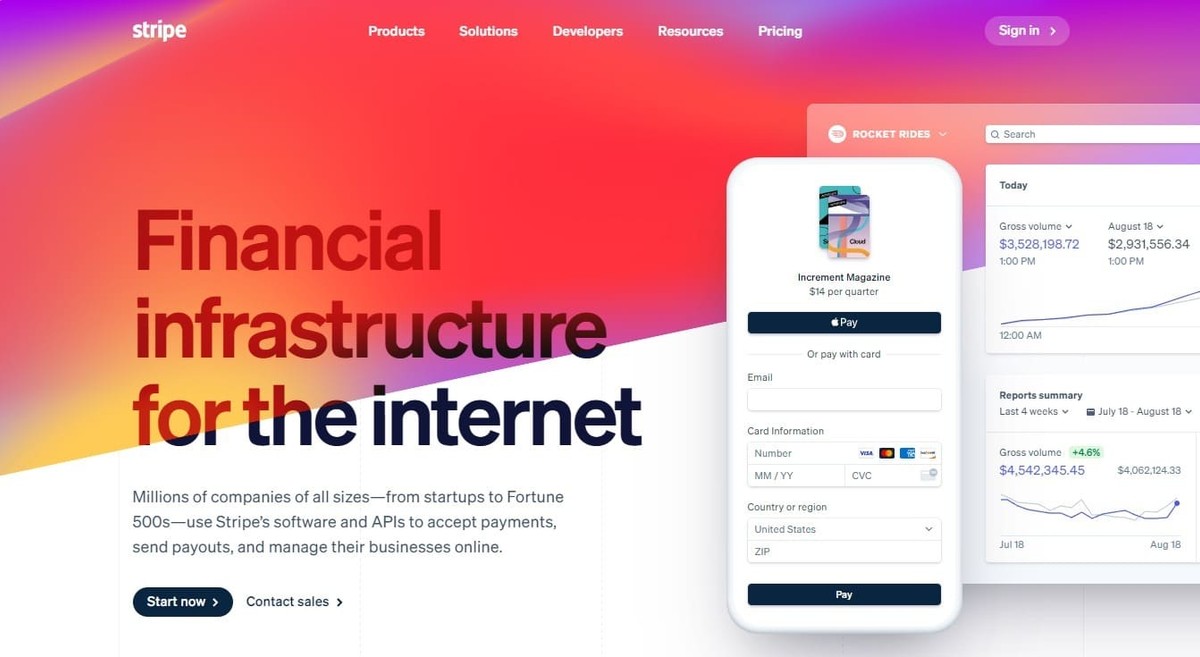

Providing convenient and intuitive payment methods for users is one of the key tasks of any business that has a digital product. The choice of payment platform affects user experience and, as a result, the profitability of the company.

Stripe is one of the most popular payment services based on a cloud platform. It quickly gained trust in the market thanks to its advantages for companies of all sizes. In this article, we will examine the key features of this payment system and explain what makes Stripe the best payment solution for businesses.

What is the Stripe payment system: introduction

Stripe is a powerful payment system that allows you to accept and make payments through websites and helps you manage your business online. The company was founded in 2010 by Irish brothers John and Patrick Collison.

Stripe handles all aspects of card payments, including card storage, recurring payments, and bank statements. The system is characterized by the high speed of payment processing and security, and seamless integration with websites. These advantages make it a popular payment gateway for companies of all sizes, including giants like Google, Zoom, Netflix, Amazon, Shopify, and others.

However, Stripe provides the same advantages for small businesses as well. Whether you have an e-commerce platform or are building a SaaS solution, Stripe has flexible setup options, which we will discuss later.

Stripe payments statistics & numbers

Stripe is widely trusted by businesses, and the statistics show it best. The service processes more than 250 million requests per day. It supports over 135 currencies and payment methods, and 90% of American adults shop online through Stripe.

Check out some more Stripe statistics:

- Stripe's payment volume grew to $1.4 trillion in 2024, up 38% from the year before.

- Stripe serves over 4.5 million websites.

- According to BuiltWith data, 3,124,751 live websites accept payments on their site using Stripe.

- Stripe is available for businesses in 47 countries.

- According to the Stripe CEO, 20,000 companies have been incorporated using Stripe Atlas, generating over $3 billion in revenue.

- Stripe has 2 million customers worldwide.

- Stripe Capital helped businesses grow 114% faster compared to their peers.

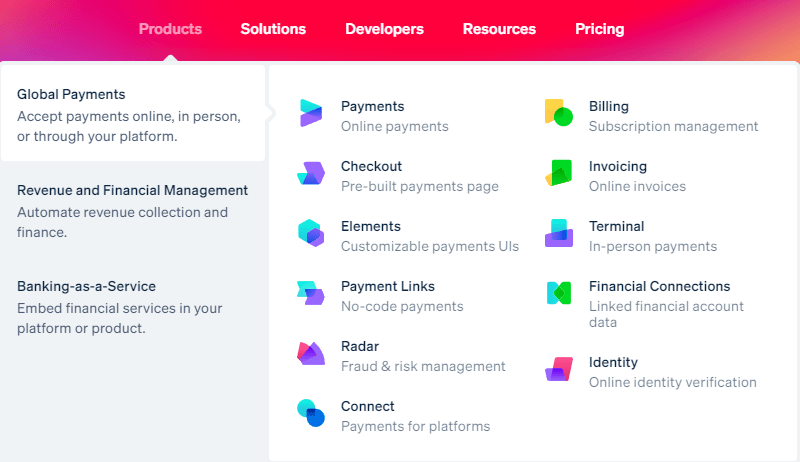

How does Stripe work: Key products and features

Stripe offers a wide range of connected products, from simple mobile payments to various financial services. This makes it useful for businesses of any size. Let’s explore some solutions in more detail.

Stripe Payment

Stripe Payment provides a wide range of accepted payment methods. From debit cards to credit cards, you should have no problems with this payment processing engine. It supports over 135 currencies. In addition to some pretty interesting international payment solutions, you also get many popular payment methods for your Stripe account, such as Google Pay, Apple Pay, Alipay, and Visa Checkout.

Stripe Payment allows customers to pay quickly and conveniently, offers low transaction fees, and is PCI Level 1 certified. The last point makes money transfers through Stripe the most secure, which is a priority for customers using online payments.

Stripe Checkout

Stripe Checkout is a pre-built checkout form you can integrate into your payment flow. It has good customization capabilities and allows you to change settings according to your needs. With Stripe Checkout, you can provide your customers with maximum convenience when making any purchases (one-time and subscription), as well as optimize the process of accepting local and international payments. It guarantees fast page loading, adaptation to all devices, and multilingualism.

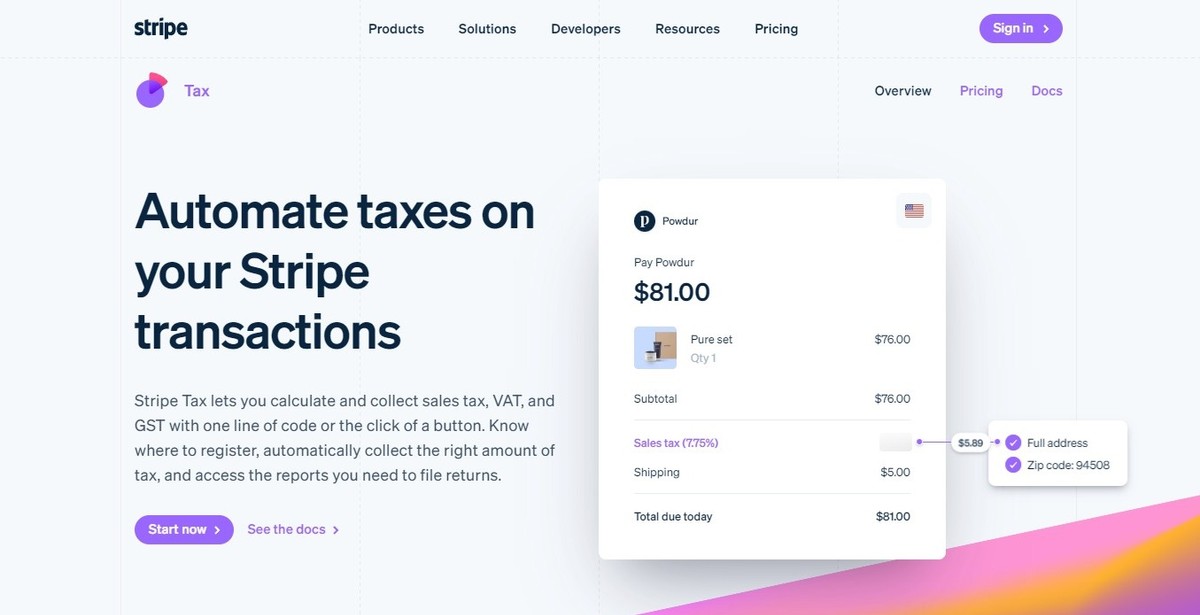

Stripe Tax

Internet businesses are required to collect taxes. Staying compliant can be challenging, especially as your business grows and has many locations. Tax rules and rates change constantly and vary based on what and where you sell. If you ignore these complexities, you risk paying penalties and interest on top of uncollected taxes.

The Stripe Tax service was developed to make tax compliance simpler so that business owners may concentrate on growing their enterprises. Stripe Tax is optimized for tax calculation in more than 35 countries and all US states. In Europe, the service enables both country and VAT OSS registrations, while in Canada, it offers both country and provincial registrations.

With one line of code or a single click, Stripe Tax enables you to compute and collect sales tax, VAT, and GST. With Stripe Tax, you automatically collect the right amount of tax and access the reports you need to file returns.

Stripe Elements

Stripe's UI building blocks help you design a secure payment experience that perfectly matches your site and helps drive conversion. Payment Elements comes with masking, styling, error handling, and client-side input validation for card acceptance. It also supports 20 payment methods without additional integration and dynamically shows the payment methods most likely to improve conversion.

Stripe Payment Links

Using Payment Links, you can create payment links to sell products or services, subscribe, or collect donations. Links can be posted on social networks and sent to customers in messages or emails. In addition, the Stripe dashboard will help you keep track of unpaid invoices and receive payment notifications.

This is a good way to get started using Stripe to accept online payments for entrepreneurs without a tech background. You don’t need any special integrations, and you can create payment links using a user-friendly, no-code platform.

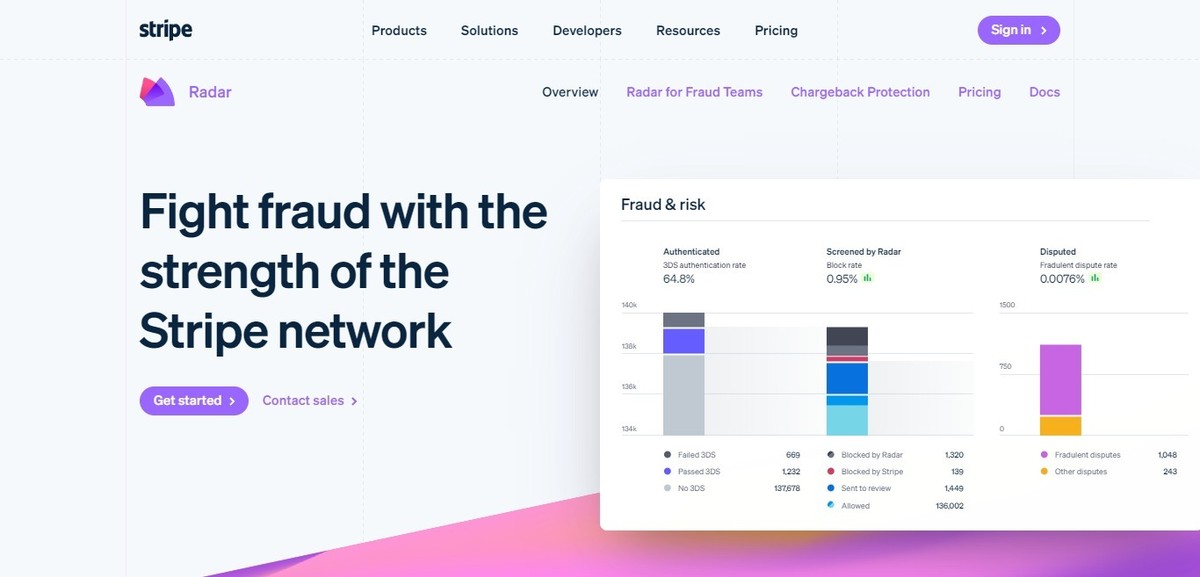

Stripe Radar

Radar is a machine-learning anti-fraud system with 3D Secure technology designed to prevent fraud. It provides maximum protection for transactions, equipment, and accounts, and allows you to set the acceptable risk of payment.

The system uses hundreds of filters to process each payment and constantly analyzes data from billions of transactions passing through the Stripe payment system around the world to accurately predict the likelihood of fraud.

Stripe Connect

Stripe Connect is another example of Stripe’s capabilities for business. It offers tokenization of card data to ensure PCI compliance and performs risk-based verification to maintain compliance with local payment and network regulations. It also helps with additional identity verification to address unique risks and compliance requirements.

Stripe Connect provides pre-built, conversion-optimized user interfaces with payment compliance plans for internal users and manages the complexities of global compliance.

Stripe Billing

Stripe's billing functionality is especially useful for businesses that work on a subscription model. It allows you to implement various pricing structures (one-time, recurring, tiered) and customize and adjust the payment collection process. The last one is relevant for sellers who regularly run advertising and promotions.

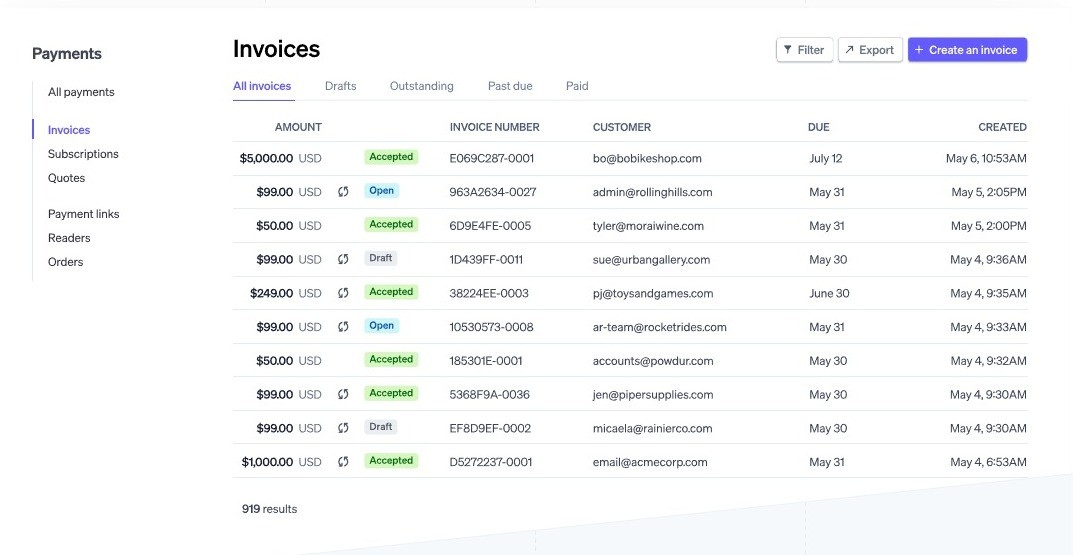

Stripe Invoicing

Stripe also provides a convenient invoicing tool: it can be either a manually created invoice or an API to add more advanced settings, such as automatic email reminders for expired payments. With invoicing, you can receive one-time or recurring payments and set tax rates directly on your invoices.

Stripe Terminal

Stripe Terminal helps you build a personalized checkout to accept payments at the point of sale. Built with platforms and modern retailers in mind, Terminal helps businesses merge their online and offline channels with flexible developer tools, pre-certified card readers, and cloud-based hardware management.

Terminal works with Connect to provide a unified payments stack with a single onboarding process, helping you unlock new revenue streams from in-person sales.

Stripe Financial Connections

With Stripe Financial Connections, users can securely share their financial information with you. This streamlines common payment processes and helps businesses manage finances.

Stripe Financial Connections allows connecting instantly to over 90% of US bank accounts and retrieving authorized data from a broad set of 5,000 financial institutions. Such integration helps speed payments and lowers fraud and underwriting risks.

In addition, Financial Connections is fully compatible with other Stripe services, so it's easy to connect for payment experience improvements.

Stripe Identity

Stripe Identity allows confident verification of the authenticity of ID documents from over 100 countries. Users get full control over who their data is shared with and can limit sensitive data access with restricted API keys.

Stripe Atlas

The Stripe Atlas helps startups quickly incorporate their businesses in Delaware. The service also includes the preparation and signing of the company's internal documents and documents protecting its intellectual property, the company's registration as a taxpayer, etc.

With the Stripe Atlas service, C corporations and LLCs can be created without lengthy paperwork, legal complexity, and numerous fees in a short period.

Stripe payment process

Let's get back to the core feature of Stripe, which is payments. So, how does Stripe payment work for both customers and merchants? The payment process takes 6 steps:

- Transaction initiation. A customer provides their payment info to start a transaction at a POS or online.

- Payment gateway. Submitted info is encrypted and securely transmitted to the payment processor or the acquiring bank through the payment gateway.

- Transaction authorization. The payment processor validates the information and sends it for bank verification.

- Bank verification. The issuing bank checks all the details and approves or declines the payment.

- Authorization response. The payment processor receives the bank's response and sends it to the payment gateway, which sends the transaction results to the business platform (online or POS).

- Transaction completion. If approved, Stripe will payout the funds to your connected bank account.

Stripe vs PayPal: which one to choose for your business?

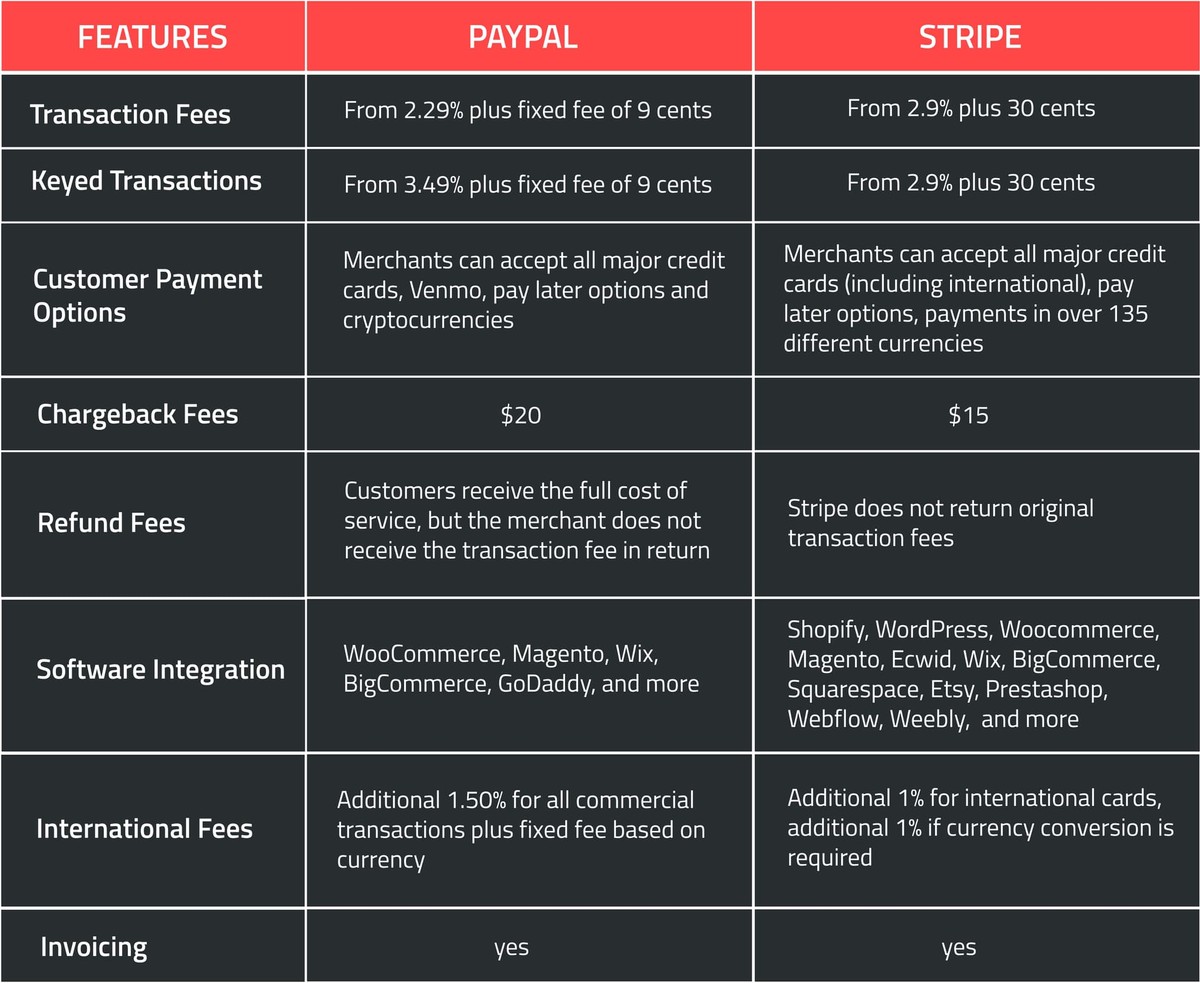

There are many payment systems on the market, such as Braintree, Paddle, Square, Authorize.net, and others. However, PayPal and Stripe have gained high trust among customers and are the leading online payment platforms today. So, PayPal or Stripe - which is better for your business?

PayPal has more than 250 million registered accounts and is used by more than 20 million merchants, making it one of the most popular e-commerce tools. It dominated online commerce for a long time until Stripe appeared.

The PayPal platform provides a wide range of user-friendly online and offline payment options. PayPal's payment processing rates range from 1.9% to 3.5% of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. The exact amount you pay depends on which PayPal product you use. A $100 transaction will cost between $2 and $3.99.

However, it can take up to three days to receive your funds. Also, PayPal has poor customer service that can be hard to reach.

But one of the biggest disadvantages of using PayPal is that your account can be frozen without warning, which can be disastrous for your business.

Stripe has a very good reputation in the world of online business, primarily due to high reliability and security, good documentation, and ease of integration with sites.

Stripe is the leader in terms of advantages among all payment systems. It meets international security standards, with Level 1 PCI certification. This is the highest level of certification available in the payments industry.

Stripe handles all payment card issues, including card data storage, recurring payments, and bank withdrawals. Moreover, Stripe's fee for swipe and chip transactions starts at 2.9% plus 9 cents per transaction, while PayPal's is 2.29% plus 49 cents. The fee for keyed transactions for PayPal is higher, starting at 3.49% plus 9 cents, while Stripe's fee does not change.

Both platforms impose additional fees for international transactions and currency conversions.

Why is Stripe the best payment solution for small businesses?

As you can see, Stripe offers a wide range of functions that make it an excellent payment solution for any business. Among other things, this is a fixed price for system services, convenient and detailed reporting capabilities, orientation to international markets, constant improvement of functionality, advanced settings, and much more. So let's look closer at the main advantages of Stripe for small businesses.

Wide Range of Payment Methods

You can use Stripe to accept payments from all over the world with various bank cards, including Visa and MasterCard, American Express, Discover, and a few other foreign credit cards, and mobile wallets like Google and Apple Pay. In addition, it integrates with almost all existing commercial applications.

Stripe works and optimizes all levels of financial flow, from direct integration with card networks and banks to payments through a browser plugin. The platform directly connects to Visa, Mastercard, American Express, Discover, JCB, and China UnionPay in global markets.

High Productivity

Stripe offers a wide range of services and products to increase your business productivity. For example, Stripe Atlas makes it easy to launch an international business, and Stripe Sigma is a simple but multifunctional reporting management tool. Moreover, a robust API provides easy integration with other platforms and good efficiency across different devices, helping your customers pay hassle-free, no matter how they choose to do it.

Advanced Features For Developers

Stripe provides a special panel designed for experienced developers that contains about 450 development tools. For example, Stripe provides out-of-the-box integrations with various CRM systems, platforms for creating websites and online stores, analytics systems, customer support services, EPR, etc.

The system already has an extensive library of ready-made solutions and options. In particular, Stripe's client and server libraries are available for such programming languages as React, PHP, .NET, and iOS.

But take note that setting up Stripe requires programming experience. There will be no problems with basic settings, but more complex processes will require help, and Seedium experts are ready to assist you in this process.

Data Security

With a full suite of both basic and advanced security features, Stripe is one of the most secure payment gateways you can use. Every Stripe account comes with the following security features:

- Address Verification Service (AVS)

- CVV/CVV2

- HTTPS verification using TLS (SSL) encryption

As we mentioned above, Stripe is a PCI Level 1 Certified Service Provider, which means it meets the most stringent standards set by the PCI Security Standards Council. This makes money transfers through Stripe the most secure, which is a priority for customers using online payments.

Pricing

Stripe has an integrated pricing structure. It gives you access to a complete payment platform and also offers pay-as-you-go rates, according to its website. Also, if you're a business owner who has to deal with a lot of high-volume transactions, you can contact Stripe to get a more personalized deal.

How to integrate the Stripe payment gateway into your business

Integrating Stripe into a website or app requires some technical expertise. Fortunately, Stripe provides clear documentation to help engineers speed up the process. Key integration steps include the following.

1. Creating a Stripe Account

The first step is to get a Stripe account. You will need to provide details about your business, including the bank account you want Stripe to send your transaction payouts to.

2. Obtaining APIs

You need APIs to integrate Stripe into your platform. You can find them on your Stripe Dashboard (“Developers” section).

3. Installing Libraries

Stripe provides libraries with detailed documentation for various languages, including JavaScript, Python, etc. You can find specific instructions on the official website and send them to your engineers.

4. Front-end Integration

The next step is to add a form where users can enter their card details and then securely submit them to Stripe using Stripe.js. Some CMS, such as WordPress, provide plugins to simplify the process.

5. Back-end Integration

Your server is responsible for handling payment creation requests. You’ll need to create a dedicated server-side endpoint to handle them.

6. Collecting Payment Details

You can use Stripe's pre-built UI components or customize your own elements to securely collect user payment information on your website. Use your public key to initialize Stripe on the client side.

7. Submitting Payment Information to the Server

Next, you need to record the payment details and securely transmit them to the endpoint on the server. To maintain privacy, make sure you use a secure HTTPS connection.

When your server-side endpoint receives the payment information, use the Stripe library to process the payment. This typically involves creating a payment intent or charge via the Stripe APIs.

Send the payment result back to the client-side, clearly indicating whether the transaction was successful, failed, or requires further action.

8. Testing Integration

Test different payment scenarios, and identify errors and bugs to eliminate all issues before launch. This is a mandatory step in any integration process.

9. Deployment

Once you’re sure the system is working flawlessly, you’re ready to go live and offer your users a convenient payment system.

Please note that this is a general overview of the Stripe integration process, and your specific workflow may look slightly different. It depends on your technology stack, system architecture, team experience, etc.

Integrate Stripe into your business with Seedium

Stripe is a powerful and smart payment system with great performance for both businesses and customers. It exceeds industry security standards and is trusted by thousands of businesses of all sizes around the world, including Fortune 500 companies.

Considering all the advantages and the impressive list of possible integrations, we believe that Stripe is the best payment solution for connecting to a website or an app.

If your business needs a reliable and secure online payment option, our professional team can help you connect Stripe to your web product. With an experienced in-house team of front-end and back-end developers, we can meet all your development and integration needs. Feel free to reach out using the form below.